The following article by G.S. Radhakrishna highlights the fact that the central government will begin taxing all temples in the country on things such as pujas, archanas, prasadam, etc. Though the article focuses on the famous Tirupati temple we should remember that 99.99% of temples in the country are not rich. The majority are small village temples that struggle to get by. In most cases there isn’t even enough money to hire proper pujaris and archakas to maintain the service of the temples. Despite the difficulty the temples face, the government feels the need to tax the temple’s and make it even harder for them to be maintained. Oddly we find no reference to taxing of churches and mosques. The government has always targeted Hindu places of worship for taxation and take over, but never churches or mosques.

As Tirupati Temple Faces Rs 100 Crore Tax Burden, Your Religious Trip May Get Expensive

By G.S. Radhakrishna

A whopping Rs 50-100 crore Goods and Service Tax (GST) burden stares at the Tirumala Tirupati Devasthanams (TTD) which manages the world’s richest temple of Lord Venkateswara at Tirumala. This is thanks to the flagship tax reform regime of the Modi government – GST – that rolls out from 1 July.

The ancient Vaishnavite shrine has all along been exempted from sales tax, wealth tax and income tax besides VAT by the Centre and state governments in the past and the current mandatory slapping of GST on temples is annoying a lot of people. “The ruling BJP and NDA spent thousands of crores on cleaning river Ganga and building Ram temple at Ayodhya but is slapping such a huge burden on Hindu devotees,” said C Rangarajan, president of Telangana Archaka Samakhya, an association of priests.

[wp_ad_camp_1]

There are 3,000 temples in Telangana and Andhra Pradesh, of which over 70 percent will come under the tax net of Rs 20 lakhs annual revenue. So far, most temples enjoyed exemption from VAT, by the respective state governments. This power has been withdrawn thanks to the GST regime and made it mandatory for these temples to be taxed. There has been a wave of protests and outbursts from pious and devout Hindus in the recent past over this.

According to unofficial sources, the pilgrimage and temple visits by the devout throughout the year brought additional revenue of 12 percent in the form of spending on transport and hospitality industry to the state exchequer.

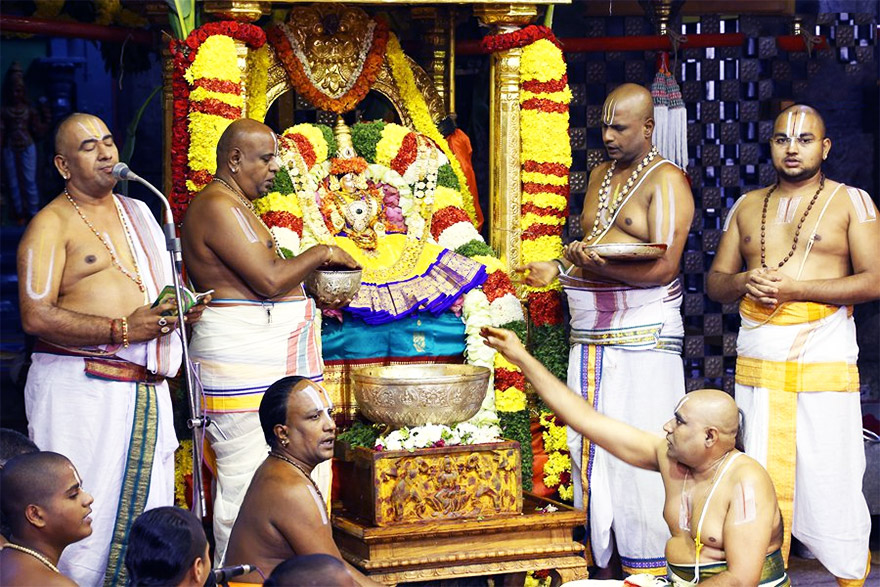

The temple of Lord Venkateswara at Tirumala managed by the TTD will be worst hit. It has a footfall of almost one lakh devotees per day and a Hundi collection of Rs 2-3 crore daily. GST will now onwards be slapped on rest-houses and services including arjita sevas and special darshan tickets.

In April this year, the TTD declared that it earned Rs 1,038 crore through cash offerings from devotees in 2016-17. During the last financial year, over 2.68 crore devotees visited the shrine and a total of 10.46 crore laddus were sold. The TTD has approved a Rs 2,858 crore annual budget for 2017-18 without any allocation towards tax payments. “We spend most of our receipts from sale of laddu prasadam, rest houses, tonsuring and others for welfare of devotees and also on our educational, medical services and on Sanatana Hindu Dharma Pracharam,” said Executive Officer, Ashok Singhal defending the demand for waiver of GST for Tirumala.

However, GST has been exempted on prasadams (what temples offered as takeaway) following representations from Andhra Pradesh and Uttar Pradesh governments, which is a major saving grace for TTD. Obviously the revenue from sale of famous laddu prasadam of Tirumala would be exempted from GST but the TTD will pay GST on all raw materials it purchases for preparation of the laddus.

Earlier this year TTD Joint Executive Officer KS Srinivasa Raju, in his representation for GST exemption said TTD provided free meals to tens of thousands of devotees every day under its Nitya Annadanam scheme and leases out its cottages and rest houses to the devout at nominal rent on day-to-day basis. “If GST is slapped on the annadanam and also accommodation, it will be a huge burden on the devotees. Till date the TTD has not paid any sales tax and it has no dealer registration either,” he told the Centre.

Unlike exemptions granted by the state and Centre in the VAT, GST on all goods and services is made mandatory even for charitable and religious institutions. Union Finance Minister Arun Jaitley has declared its imposition as non-negotiable. He also reiterated in a series of discussions with state representatives including ministers, officials and MPs from the Telugu-speaking states, that unlike in the case of VAT, state governments have no say in implementation of GST and that they have no powers to exempt GST in their jurisdiction.

“The Centre has made GST collection mandatory even on temple revenues – sale of services like sevas, prasadam and accommodation. Our appeal that the TTD should be exempted from GST has been rejected by the Union Minister,” said Andhra Pradesh Finance Minister Yanamala Ramakrishnudu who raised the first protest at last month’s meeting on GST at Delhi.

He has written to Arun Jaitley to consider reducing the GST rates on 10 goods and services including agarbattis (incense sticks) and cashewnuts. Ironically, the Andhra Pradesh Endowment Minister Manikyala Rao, a BJP nominee in the Chandrababu Naidu government is silent on the issue. But VHP, RSS and other Archaka forums in AP are up in arms and blame the Centre for ignorance of temple administration. “Probably NDA government is unaware of the fact that the majority of temples in south are managed by the endowment department and not private trusts as it is in North India,” said A Atreya Babu, president of the Andhra Pradesh Archaka Samakhya.

The situation is the same in Telangana where Bhadrachalam – the land of Lord Rama’s stay in Dandakaranya – is a main temple attraction. The Yadadri temple town near Hyderabad is now promoted by Telangana Chief Minister K Chandrasekhar Rao on par with Tirumala and very recently ticket system, queues and cottages were organised. “The GST on temples is unjustified and a conspiracy of the Centre to rob the state’s resources,” said Telangana Endowment Minister A Indrakaran Reddy.

Reddy said temples were a state subject and the state government subsidised maintenance of popular temples under the Dhoopa-Deepam program for conduction of rituals. He plans to take up a protest against the Centre as GST on temples hindered the development of temples in the state. “The government should not stand between God and devotees,” he told FirstPost contending that taxing services in temples was a violation of freedom of religious expression.

Dr C Rangarajan, custodian of the temple of Lord Venkateswara at Chilkur on the outskirts of Hyderabad, popular as ‘Visa temple’, questions as to why the custodians of Hindu religion and temples like peethadhipathis and trustees of religious institutions were not consulted before imposing GST on temple revenues. “We should take the protest campaign on social media as well and involve the Members of Parliament (MPs) from south India,” he said.

TTD on Service Tax

TTD had challenged the provisions of the Finance Act, 1994 in February 2014 in the Supreme Court stating that service tax is violation of Constitution Articles 26 (freedom to manage religious affairs), 27 (freedom as to payment of taxes for promotion of any particular religion), and 14 (right to equality).

TTD had earlier challenged the imposition of service tax on the accommodation service provided by it, but the Andhra Pradesh High Court dismissed the writ petition in 2012. Later the TTD had changed the title of guest houses into ‘rest houses’ and escaped payment of service tax. The TTD operated nearly 7,000 rooms including 5000 at Tirumala.

In the case of laddu prasadam VAT, the court had approached Customs, Excise and Service Tax Appellate Tribunal (CESTAT) which held that the prasadam is the blessings of a deity which has a great religious significance and hence it cannot be made eligible for taxation.

The mandarins at TTD are already worked up over rising costs and deficit accounting in spite of increasing revenues from sale of tonsured hair and other accounts. While the TTD spent a whopping Rs 350 crore towards procurement of ingredients for preparing the famous laddu, the income earned by way of its sales is a paltry Rs 165 crore. They are worried that the drain of Rs 185 crore on the exchequer is likely to widen during the ensuing financial year with no let-up in the soaring prices of essentials and now the GST.

Slashing of interest rates from 5.5 percent to 4.25 percent by the Reserve Bank of India (RBI) on fixed deposits of Rs 10 crore and above during November 2016 severely impacted the prospects of the income of the TTD, which has staggering deposits worth about Rs 10,500 crore with various nationalised banks. Its gold accounts have also nosedived with the recent gold policy of the Modi government and TTD was more or less pressurised to deposit its gold (daily 2 kgs of gold collected in its hundis) in the scheme.

Pilgrims now anticipate a minimum 20-30 percent hike in the cost of their trips. Endowment officials say that the pilgrim rush to other religious centers at Vijayawada, Simhachalam and Srisailam in Andhra Pradesh and Bhadrachalam and Yadadri would go down drastically with the GST regime. “For Andhra Pradesh and Telangana, religious tourism is a major revenue earner and the GST will foil it. 80 percent of Andhra Pradesh’s tourist revenue is from Tirupati only and such GST on temple revenues will have cascading impact on temple tourism,” said Venkatachari, a retired Endownent Department official of Andhra Pradesh.

Source: firstpost.com

This is a pathetic turnaround

It is a pity that in a country which is basically a Hindu dominant,

the Hindu temples, religious centers only are controlled by the

Government and all levies imposed on them. There is Government

controlled Endowment Board which imposes all restrictions and

controls the finance. There is NO CONTROL on the working or

finance of the Churches or Mosques which is mostly financed by

foreign donations.

This anomaly is deplorable and needs to be removed Either scrap

the controls or impose it uniformly, irrespective of the religion.

Yes, better it is applied uniformly irrespective of the religions i.e. to be applied on all the religions. Moreover, all religious places shall be periodically audited, not only financially but also the facility & national security viewpoint, by the government. This will eliminate all nuisances and religion will become ‘RELIGION’ in right perspective.

its a sad state of affairs that in the largest democracy in the world, one has 2 forbid the liberty to offer Bhagwan/Bhagwati … that too offered, wld b taxed !! if this implementation is made to other religions in the country, what wld b the result / response ?? answer is within yourselves, its obvious ….

most of the temples across our country is struggling 2 run daily affairs of the temple and our govt. is soon planning 2 implement tax/taxes …….. why ? no govt. should come forward such steps, please.

thanks

They asked for votes in the name of religion. Everyone said Congress is anti-hindu now BJP/NDA on the same path as congress. In Rajasthan they broke many temples in the name of land for road but never even touched any dargah or mosque even though many are still situated between the road.

BJP is another face of congress only. Yet to see what they do for ram mandir. Forget about lessening of tax burden on common man or things or fuel getting cheaper. They’ll do nothing against Gandhis or vadras, it was all a showoff for votes. They’re all one on inside.

Everyone is out there to wipe out hindus.

Its very unfortunate that BJP which boasts of coustodian of Hindu is doing such blunder by taxing Hindu temples. Hindu temple are places where traditional pujas and prasadam are part of daily routine and performed by voluntary offerings from people. Its is highly regretted that this money is taxed. Lord Venkatesha will not see his money being looted by BJP govt. The BJP will surely see the warth of Lord Balaji and will be definetly punished for this act of taxing his resources.

Shame of BJP govt. When some many kings and govts. from centuries have donated to tirumala. These Govt. Is taxing the Lord Venkata. Shame on BJP govt.

It is a fact that Hindu temples are literally governed / administered / and managed by the so-called Administrative officers of the Governments in all the States and it is conveniently called Hindu Religious Endowment Boards and is a source of Income to the Governments already! How about Mosques and Churches? You dare not touch them!

If controlling the activities of Hindu temples by State enactments, leaving out places of worship of other relgions

uncontrolled, impostion of levies on Pujas and contributions earned by way of offerings of devotees is much worse.

Is this what our secular Constitution permits and is this the way of treating all religious institutions equally and equitably?

Hindu community is forced into vigorous protests against this injustice.

This shows the stupidity of Hindus in non unity of all Hindus due to caste differences etc.Even now we must ‘delete’ caste and use ‘Occupation’ and make all Hindus equal in all matters.

Regarding taxation,Hindu temples Exhibit wealth with kilograms of gold jewellery and waste lot of money and other useful things as compared to other religions.

And most important thing is, Hindu people compete even at the cost of own religion to get votes of other religions.So it is to get power even at the cost of self respect and power.

The Modi government should consider the feelings of Hindus when only Hindu Temples are covered under the GST Tax ruling.

As TTD has questioned why churches and mosques are not covered under the GST Tax

Arun Jaitley FM should reconsider this decision before there is agitation from thousands of Hindus.

India is in great need of basic social services, hygiene and cleanliness. Over thousands of years these basic needs have been neglected by religious leaders. Finally the government is stepping in and starting to collect the means that can help to make a beginning to fill these needs.

BJP proved to be no different in appeasing other religions at the cost of Hinduism. What is R S S doing is it made to shut its mouth?

What a pity? BJP is ahead of Cong in appeasements under different policies. 2019 should teach a lesson to such parties.

The BJP is perceived to be Hindutva- ie pro-Hindu. But once in power, they are showing themselves to be money-hungry and unprincipled like any political party,, plundering Hindu temples, much like the Muslim invaders! They looted, these are robbing in small instalments! Remember the previous govt eyed the temple gold? Let them touch the rich churches and mosques if they have the guts! The whole world will raise a hue and cry! We Hindus are senseless- we tolerate everything!

But Hindus also should learn to be smart and outwit the govt. They should not “sell” anything! Get it?

One more thing. The temple authorities and priests should not show any special consideration or show of favour to central officials , ministers and politicians. Let them all stand in the queue like the rest of the countrymen!

But one thing: they have touched Lord of the Seven Hills! He will show the BJP its place!

Arrogance of Power will lead to downfall. Vinasha kaale viparita buddhi.

Completely agree with Kalyankishan and one should inform central government to think it over before implementing GST only on temples.

Jayant joshi

Has govt gone totally insane to particularly cover Income of Hindu temples under GST?we hope better sense will prevail on govt to retrace the steps on GST ON Hindu temples

I personally feel that law should be the same for all in India. Why should only Temples be Taxed by the Government ?

From the entire writing I could understand only one thing tha Hindu Religious are singled out, whereas curches and mosques remains untouched.This is only discreminatory. Religion is an individual faith. In such matters Government must keep itself away. Unfortunately our leaders for their political advantage use religion as item to befool the public.

Next comes the TTD. Offerrings of the devotees is 1038 crores. It is not income of the temples. supposed to be spent on deotees. Expenditure for feeding the devotees of 2.68 crores asssuning 100 rupees for devotee comes to 268 crores. if it is 200 rupees for devotee it may exceed 500 crores. Distribution of laddus either free or sale may be around 200 crores. Where is the shortfall. If tghere is any shortfall how TTD can build up 10500 crores deposit. What they will do with this money? Let us not oversympathise the religious institutions.

Sad turn of thinking; IF you wish to tax places of worship, two things are important; One, NO discrimination please; all religions have to be uniformly covered; Two, a proper limit should be laid down, as in case of Income Tax, for tax

collection to be applicable – Pray God good counsel prevails and all folks are treated with same privilege/concession !

In Cristianity and Mohamedan religion there is no paid poojas or paid prayer by individuals or group of individuals.Most of the prayers in a mass gathering free of charge like mass, or namaj .

In Hinduism there is no system of mass prayers, or poojas. There are nameplates or details put on Notice Board or in a leaflets, literature, books , monthly magazines asking devotees to subscribe poojas on certain days in a month or year contribute certain causes like, free bhojana to poor or disciples of temples.

Government is keeping eye on such donations or contributions to tax them.

If a church is constructed at a place for worship , it has many more functions like baptism of child, death ceremony, or last rites , marriage ceremony , keeping records birth and death s etc . There are many more rituals performed in the Chrches. Of course all such services are charged and not free.as they have to manage the churches.

Above all it is necessary to highlight here about the Churches.

1.There must a burial ground for the departed.

2. There is a provision for oldge homes with free food and care. and for destitutes attached to Churches.

3. There is also a Hospitals with minimum facilities connected to Chrches .

4. Above all, they establish schools and technical inttutes in which they provide free education, training to poor, This is a real boon to get employment in Arab countries like, electricians, turner, fitter, mechanics, draftmans , driving and motor car repairing etc.

If one observes now there are popular schools and colleges and engineering colleges established by these church authorities

.

FOR CRISTIANs the CHURCH SERVICES LIKE INSURANCE SERVICE PROVIDES EVERYTHING TO SURVIVE IN THE WORLD.

So if this is going through.

1. Let govt. spend back money with in hindu community whatever they have taken by way of tax.

2. Employ tax uniform across religious institution

3. Publish detailed report on how much is collected n how much and how they are utlized.

Satyanarayana Murthy Ravipati is right, to some extent. Tirupati is an exceptional temple. Perhaps the only other temple in the South which attracts some money is the Palni temple in Tamil Nadu.

It is a fact that this temple has huge funds. But all this is given by the devout Hindus voluntarily. How can the govt claim or covet it?

TTD should learn a lesson from Dharmasthala. in Karnataka. There, the adhikari, Veerendra Heggade understood long ago that if the temple has funds, govt’s greedy and nasty eyes will fall on it. So, he started using the funds to feed the pilgrims free! it has become legendary and a model to some other big temples in Karnataka.

TTD should also do some such thing. One thing is for sure. They should not simply succumb to this evil design of this govt. For one thing, they may waive all fees for all sevas for one year, declare only dharma darsan , restrict laddu prasada to visitors, and accept only anonymous donations from the Hundi. Let there be no formal charges, and no special treatment for anyone! We can review the experience after a year.

We may learn from obstacles,too!

While I question the gst for temples (excluding mosques and churches), I do not understand why the TTD with 10,600 crore deposits earning 4% interest should not pay gst on current income. They have to raise the price of the tickets for darshan ? How pathetic!

let there uniform law with regard to place of worship – administrative control, taxes and subsidies as a first step before we harp upon uniform civil code forevery thing

Take the government to court base on discrimination…..Hindus cannot be persecuted. It taxation is the law is has to be for all religions.

First we must confirm this information. Next the GST collection is at State Level. Was this idea from Center of State ? Is it applicable only to Tirupati ? We must register our disapproval. It is not practical to implement in any place of worship. Already temples are paying GST for the purchases made for the temple. Why GST again?

This is rediculus to tax on tempel only

Mr Modi and Jaitley are operating a tax collection regime

50percent of tax are looted by tax collecting agency they cannot prevent that

This is like JIJIYA KAR

Hindus are majority in INdia but treated as minors If this attitude continues by governments, it may lead to unrest. Why the amounts gained by temples may be spent other than religious activities. Devotees donate money to temples for only religious purpose.

If you want to have control on temples have control on masjids, and churches also If you want to give money for haz give money to hindu pilgrims also.

Please revert the GST on temple sevas

GST is a tax that is applicable to all situations where goods are sold or services provided on payment basis. It is not specifically targeting any religious place be it a temple ,church , mosque, gurudwara or a synagogue. It applies to all places where goods are exchanged on payment or service provided on payment. If any religious place finds that its existing practice is attracting payment of Tax, then they have to use their ingenuity to find a nomenclature which will not attract payment of Tax.

It is wrong to be agitated against payment of Tax if your present nomenclature is going to attract tax liability.

For undertaking development works and looking after the welfare of the people funds are required, which every government raises by leivy of taxes.

It had all started with Sonia’s pet in AP, who was a Catholic and CM of AP viz Y S R Reddy. He was a devout Christian who levied tax on Tirumala-Tirupati Temple and subsequently took over its management under AP Government. It paved d way to ruin the temple management. He did not attach Churches or Mosques. Only Hindu Temples were attached.

Some agents of opposition in babudom must have introduced to harm BJP in next elections. If BJP fails to see this it will sit again in opposition in 2019.

This is a pathetic procedure and rule for HINDUS. And what about church’s and mosques ??????? India is INDIANs and the Indian culture and traditions SHOULD COME FIRST, like in the Christians and muslims countries ?????? WAKE UP INDIANS

We all expected that Modi Govt would take some steps to safeguard the interest of all Hindu temples, but unfortunately they are turning a blind eye towards this and are trying to squeeze money from the temples by way of Tax and other forms. Since no such taxes are levied for churches and mosques, why this discrimination towards Temples ?? this will be the only country where the majority community is subject to ill treatment. We Hindus have to unite together and fight for the common cause and see that our Temples and place of worship are not unnecessarily interfered by Govt or other people.

What sundar kelka is trying to tell is church does many welfare activities and temple don’t do those works . Hence should be taxed.

Please for Gods sake don’t try to instigate and preach to gullible Hindus about sanctity of church. We are not intrested.

If temples are left on their own many such things are done. One thing Kelkar don’t understand is the concept of “arjitha seva” It is a worship done by the devotee by paying the required expenditure to the temple management. The temple will have a fixed pujas whose expenditure is met by the assets of the temple. They are done even with out any contributions from devotees.Example Ashtotharam archana done once a day at a fixed time say in the morning pooja. Isf a devotee comes in the evening and wants a ashtothara archana the temple collects the expenditure for that for the flowers etc. This is a system developed to meet the expenditure of the temple .The arjitha sevas are the pujas performed by the devotee like as a fulfillment of a wish. Exactly this is what the government is misusing by charging money.When a kalyanotsavam is performed with a total expenditure of say ten thousand the same is paid by 10 people 1000 each. But the present endowments department charging 1000 each even the number of devotees are 50. It makes Rs 50,000 for an expenditure of Rs 10,000 his is where the income to the government is multifold,and no governments not going to loos this income. Any the government is taking all the collections and leaving nothing for the upkeep of the infrastructure. Temple committee has to beg for the funds to repair , renovate, and to create new fecilities , and sanitation requirements of the temple premises. Hope Mr.Sundar Kelkar understands this.

While this debate is in progress, the question of can an archanai or blessing or a divine prayer given from the heart and soul by a pujaari or archaka be reduced to a mere commercial transaction of give and take that falls under the jurisdiction of GST – if the beneficiary receives a promotion, good health etc. Eventually through positive vibrations and blessings , is not the archak or Temple giving a service far outweighing the seva fees? Granted most temples these have become routine prayers but in villages etc. sincere pujas are still carried out

They stand to get affected if a divine prayer gets bundled into a GST service.

If Hindu Temples reduce hoarding of excess funds and help solve pressing Environmental and poverty gaps seen everywhere today, the Kali Purush will not be able to use the government itself to start giving financial pressures and burdens on temples having existing heavy donation deposits. Just like cinema industry, actors act in poor people roles and later shift to a rich life with viewers’ tickets money, temples are in that mode in current situation. The only way to get out of tax pains for them is to become more spiritual, service -oriented in their functioning.

Temples must also ensure that in fear and scarcity atmosphere created through GST , they do not fall prey to investment schemes and push towarda securitizing themselves. India today is in holds of bankocracy and technocracy who stand to benefit whichever way the cookie crumbles.

Temples must also ensure that in fear and scarcity atmosphere created through GST , they do not fall prey to investment schemes and push towards securitizing or market driven ways. India today is in holds of bankocracy and technocracy who stand to benefit anyways.

It seems to be more of an economics-driven decision to me as the majority of worship places are Hindu Temples presently – thus more the revenue. Instead if there were more mosques etc. they would have been the target of taxation I guess.